Reports Tab

As commercial motor vehicles buy fuel, any fuel tax paid to the states is credited to that licensee's account. At the end of the fiscal quarter, the licensee completes the fuel tax report, listing all miles traveled in all participating jurisdictions and all gallons purchased in all jurisdictions. Then the average miles per gallon is applied to the miles traveled to determine the tax liability to each jurisdiction. Three states—Kentucky, New Mexico, and New York—have "weight-mile" taxes in addition to the standard fuel tax; Oregon has just a weight-mile tax.

Any fuel taxes due (or refunds due) are then paid to (or by, in the case of a refund) the base jurisdiction that issued the license. The member jurisdictions then take care of transferring the funds accordingly. Audits are conducted only by the base state and fuel bonds are rarely required.

IFTA requires payment to the base jurisdiction in that filing month and no later or the company will be fined.

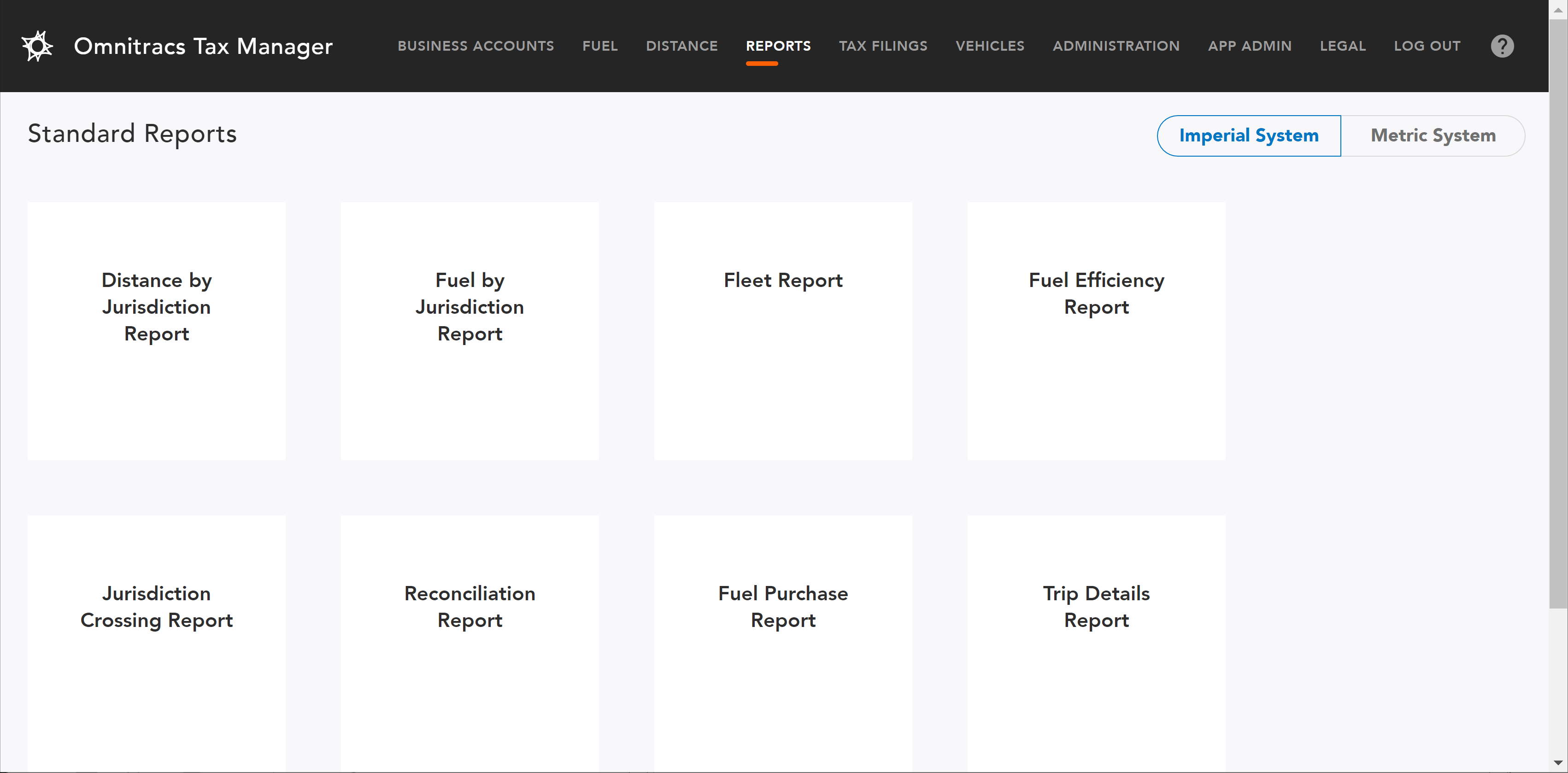

Reports - Basic Navigation

Several different reports can be run from the Standard Reports screen.

- If necessary, click Imperial System or Metric System to ensure the report will use the proper measurements for the jurisdiction.

- To run a report, click on the report name. The Preview window for the report opens.

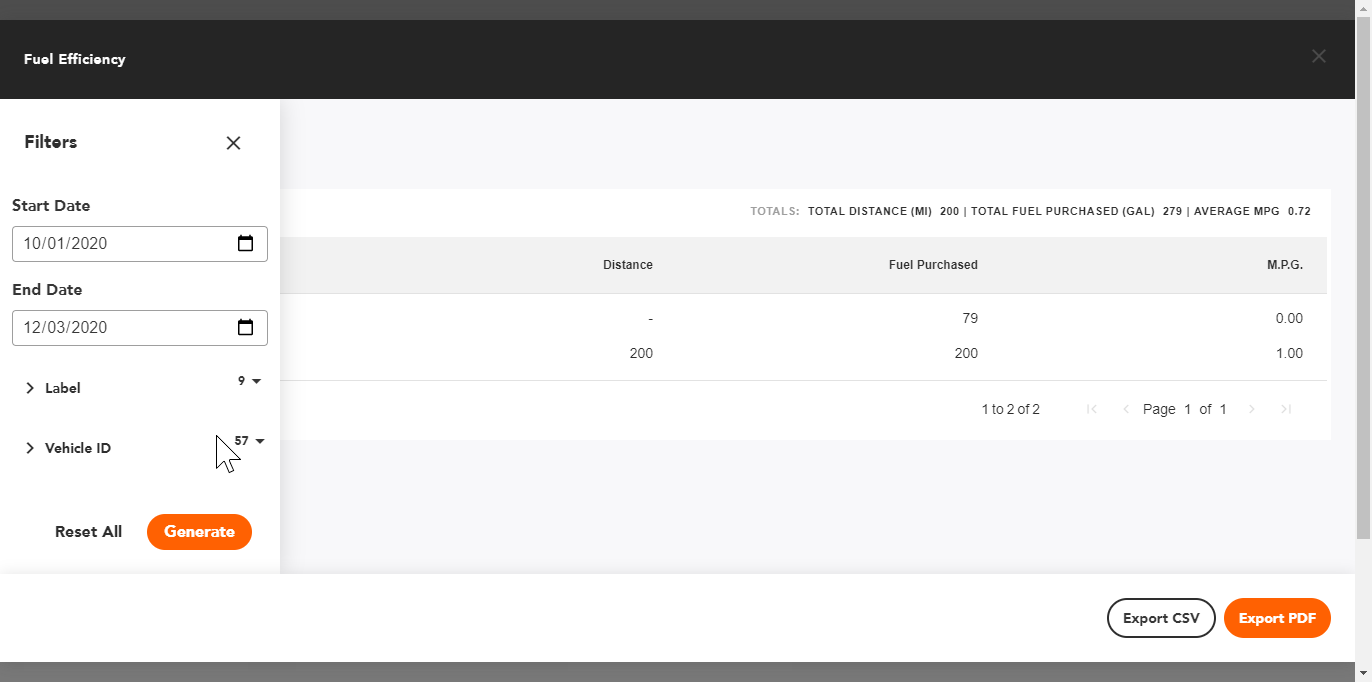

- Click the Settings icon to open the Filter for the report. You can use the Filter to limit the data that will be included in the report. The filters vary depending on the report, but may include dates, jurisdiction, tax account, or vehicle ID or label.

- Once the filters are set, click [Generate]. The report is displayed.

- To export the report to a pdf or csv, click [Export PDF] or [Export CSV].

Distance By Jurisdiction Report

The Distance by Jurisdiction Report is used to determine the total distance driven in each jurisdiction by each vehicle. You can view the Distance by Jurisdiction Report on your screen, print the report, or export the report data in PDF or CSV format. For more information about this report, see Distance By Jurisdiction Report.

Fuel By Jurisdiction Report

The Fuel by Jurisdiction Report is used to determine the amount of fuel purchased in each jurisdiction for each vehicle. You can view the Fuel by Jurisdiction Report on your screen, print the report, or export the report data in PDF or CSV format. For more information about this report, see Fuel By Jurisdiction Report.

Fleet Report

The Fleet Report is used to determine distance and fuel in each jurisdiction for each vehicle, and to validate fuel and mileage data to prepare for tax filing. You can view the report on your screen, print the report, or export the report data in PDF or CSV format.

The Fleet Report is useful for International Registration Plan (IRP) renewals, insurance assessments, audits, and Commercial Vehicle Operator's Registration (C.V.O.R.).

For more information about this report, see Fleet Report.

Fuel Efficiency Report

The Fuel Efficiency Report is used to individual fueling records for each vehicle and to help validate fuel and mileage data to prepare for tax filing. You can view the report on your screen, print the report, or export the report data in PDF or CSV format.

The Fuel Efficiency Report is useful for International Registration Plan (IRP) renewals, insurance assessments, audits, and Commercial Vehicle Operator's Registration (C.V.O.R.).

For more information about this report, see the Fuel Efficiency Report.

Jurisdiction Crossing Report

The Jurisdiction Crossing Report provides details about each time a vehicle crossed from one IFTA taxing jurisdiction into another. This report includes information such as the date, time, GPS coordinates, vehicle odometer, and the name of the jurisdictions the vehicle entered and departed.

You can view the Jurisdiction Crossing Report on your monitor, print the report, or export the report data in PDF, Word, Excel, or CSV format.

For more information about this report, see the Jurisdiction Crossing Report.

Reconciliation Report

The Reconciliation Report provides information so you can audit your IFTA taxes for vehicles in your fleet. The report provides an accurate breakdown of the tax calculations by vehicle, with data for each jurisdiction listed under the vehicle. For each jurisdiction you can see the fuel tax rate, any surcharges, the total mileage, the amount of fuel purchased, among other pertinent information.

You can view the Reconciliation Report on your screen, print the report, or export the report data in PDF or CSV format.

For more information about this report, see Reconciliation Report.

Fuel Purchase Report

The Fuel Purchase report allows you to filter and export fuel purchases that were loaded into Tax Manager so that they can be review and audited. The report includes the vehicle ID, date and time of the purchase, the jurisdiction where the purchase was made, and the amount of fuel purchased.

You can view the Fuel Purchase Report on your screen, print the report, or export the report data in PDF or CSV format.

For more information about this report, see Fuel Purchase Report.

Trip Details Report

The Trip Details report shows every recorded position of a vehicle, so that in the event of an audit you can provide a bread crumb trail to display where the vehicle traveled through during a selected period of time. The report includes the vehicle ID, the date and time when the Telematics device logged the position of the vehicle, the latitude, longitude, and a description of the vehicle's position, the jurisdiction the vehicle was in at the time and the odometer reading.

You can view the Trip Details report on your screen, print the report, or export the report data in PDF or CSV format.

For more information about this report, see Trip Details Report.