Reconciliation Report

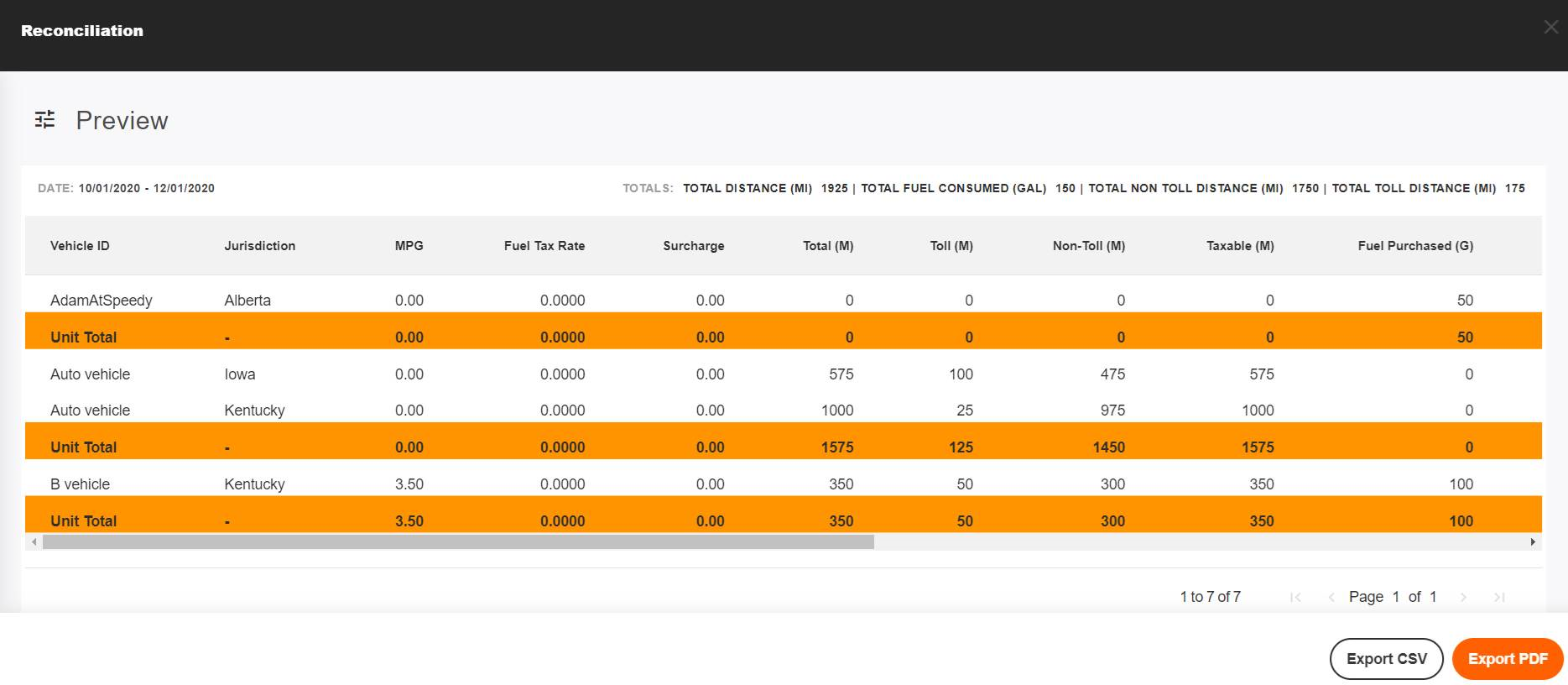

The Reconciliation report lets you audit your IFTA taxes for the vehicles in your fleet. It provides an accurate breakdown of the tax calculations by vehicle, with data for each state listed under the vehicle.

Note: Vehicles that have zeros "0" in the MPG or Fuel Tax Rate column may not be configured as IFTA reportable, but are still available for reports for Highway use tax and for informational purposes. To exclude Non reportable vehicles consider using Labels to add additional filters to your reports.

Running the Report

- Click Reports. The Standard Reports list opens.

- Click Reconciliation report. The report opens.

- Click the Settings icon to open the Filters panel.

- Select the date range for the report.

Note: You can run the report for a single month, or a single quarter, but you can not span multiple IFTA quarters. For instance, you can run the report for Jan 1 - March 31, Jan 1 - Jan 31, but not from March 1 - April 30. - Use the Tax Account, Label, and Vehicle ID to filter the report to include the vehicles you want.

- Click [Generate]. The report appears on the screen.

- To export the report, click [Export CSV] or [Export PDF].

Report Details

The table below provides the path to the report and shows the reporting period and range.

| Report Location | Reports Tab > Reconciliation Report |

| Data Retention | Data is retained for six years. |

| Maximum Reporting Period | A single IFTA quarter. For instance, you can run the report for Jan 1 - March 31 but not March 1 - April 30. |

Report Fields

| Field | Description |

|---|---|

| Vehicle ID | The ID of the vehicle. |

| Jurisdiction | The state or province the data is for. |

| MPG | The mileage for the vehicle in the jurisdiction. |

| Fuel Tax Rate | The tax charged per gallon in the jurisdiction. |

| Surcharge | An additional charge the jurisdiction assesses on top of the IFTA tax rate. |

| Total (M) | The total number of miles the vehicle drove in the jurisdiction. |

| Toll (M) | The total number of miles the vehicle drove on toll roads in the jurisdiction. |

| Taxable (M) | The number of taxable miles the vehicle drove in the jurisdiction. |

| Fuel Purchased (G) | The total amount of fuel purchased for the vehicle in the jurisdiction. |

| $ Over/Short | The amount of additional tax owed the jurisdiction in dollars. If the amount is in parentheses (), it represents a credit. |

| Mileage Tax Rate | The highway use tax rate for the jurisdiction, in dollars. |

| Mileage Tax (USD) | The total amount owed the jurisdiction, in dollars. |

| Final $ Over/Short (USD) | The final amount owed the jurisdiction, taking into account all charges and credits. If the amount is in parentheses (), it represents a credit. |