App Admin Tab

Overview

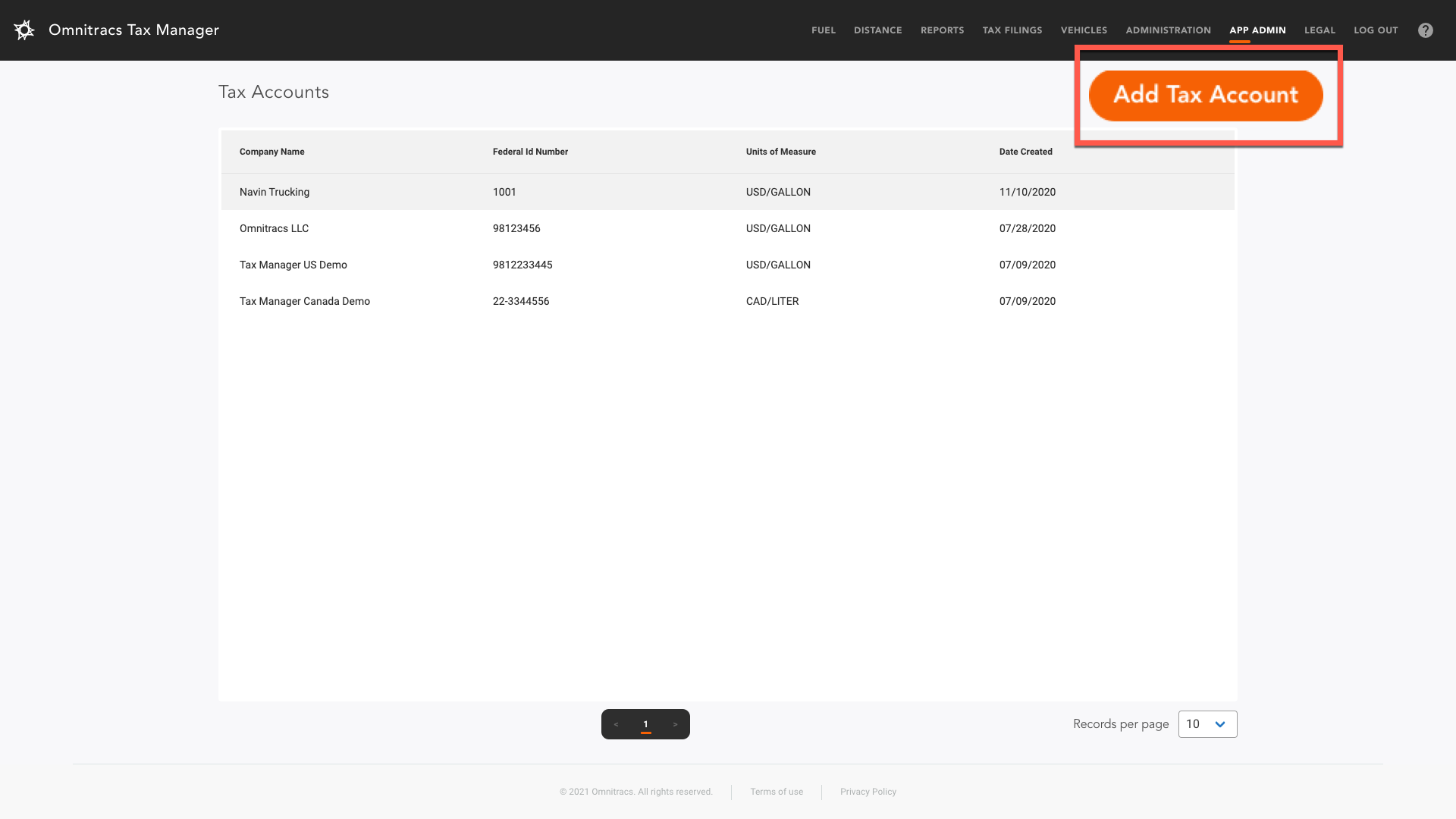

The App Admin page allows you to manage your Tax Accounts.

You can add, edit, and assign or unassign tax accounts and vehicles from this page.

Add a Tax Account

To add a Tax Account, click the ADD TAX ACCOUNT button from the App Admin page.

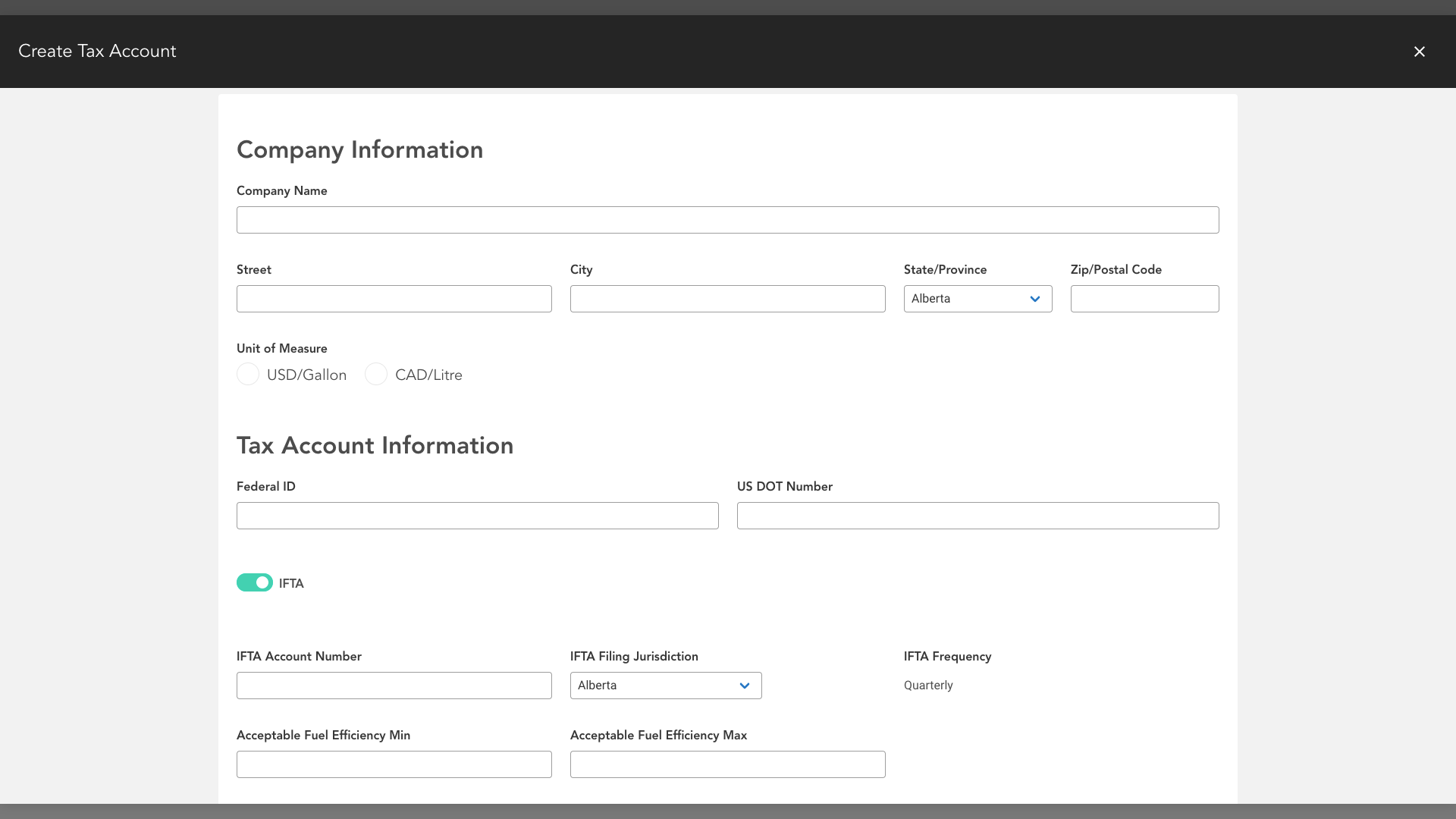

You will be directed to the CREATE TAX ACCOUNT page.

Enter your Tax Account information in the fields as necessary.

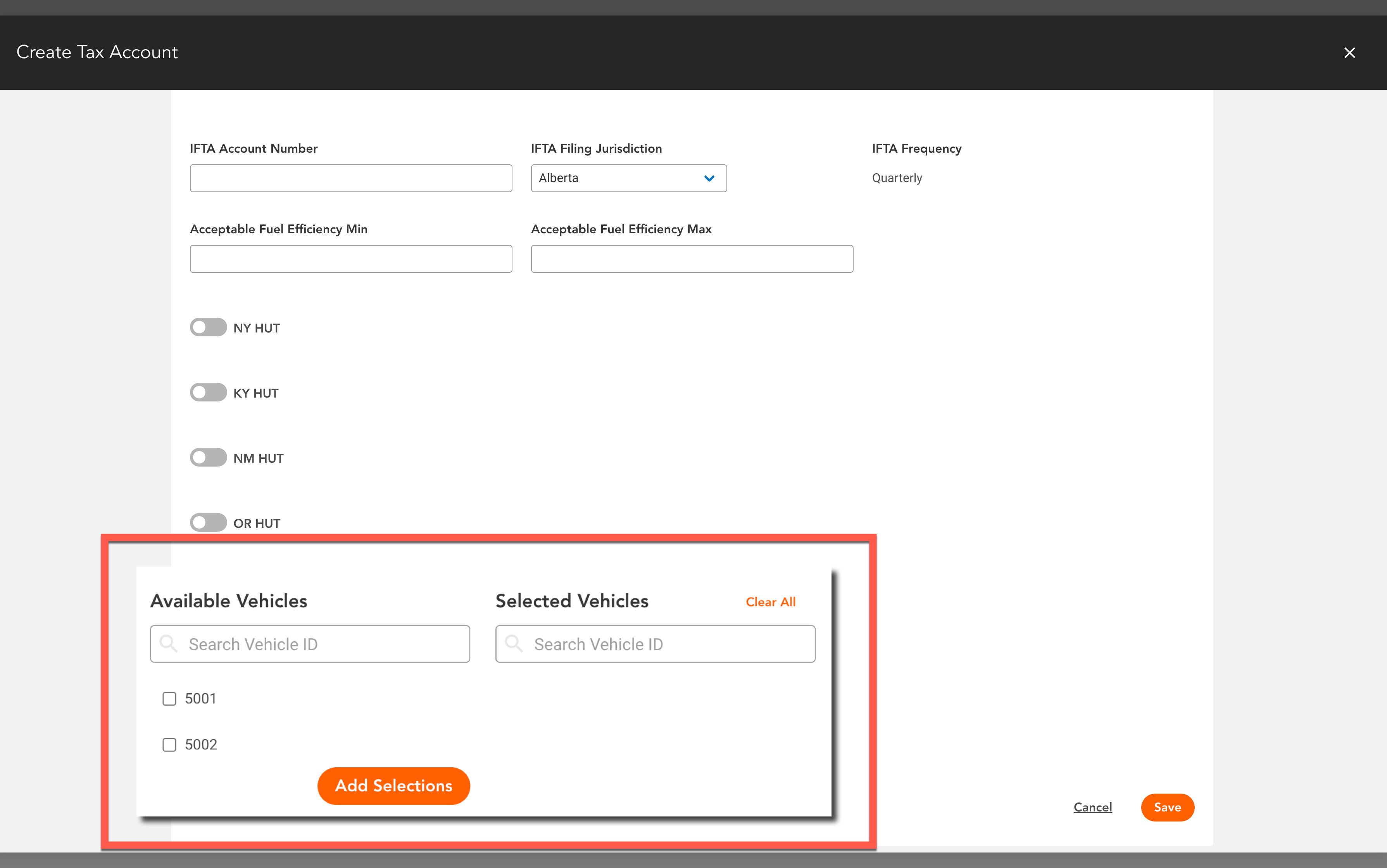

Scroll down the page to complete the fields.

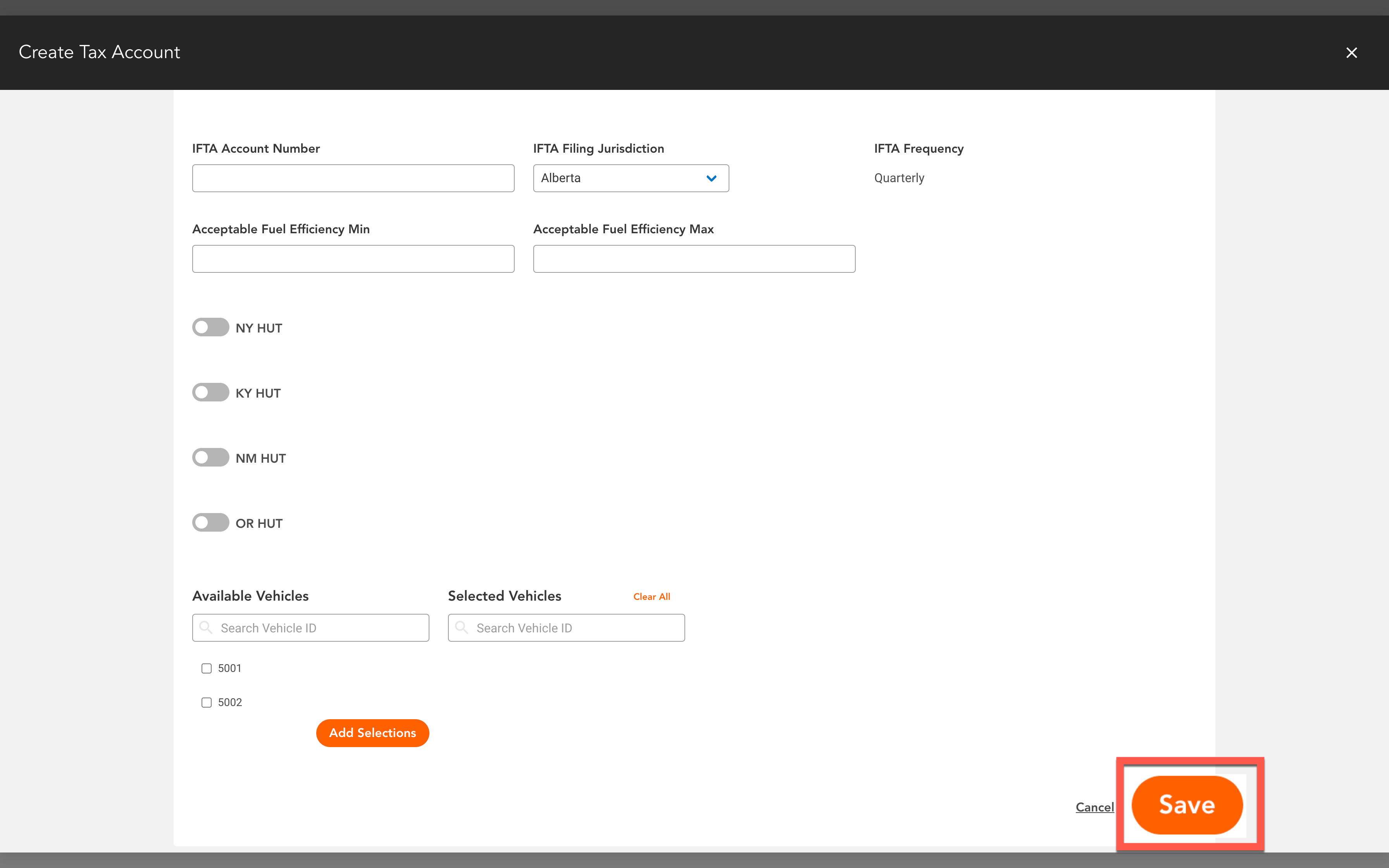

The last task on this page will be to assign vehicles to the account.

Under the AVAILABLE VEHICLES column either type in the vehicle ID or click the check box next to the vehicle number shown on the list.

Once you make your selections, click the ADD SELECTIONS button to add the vehicles to the SELECTED VEHICLES column on the right.

Click SAVE when all necessary fields are entered.

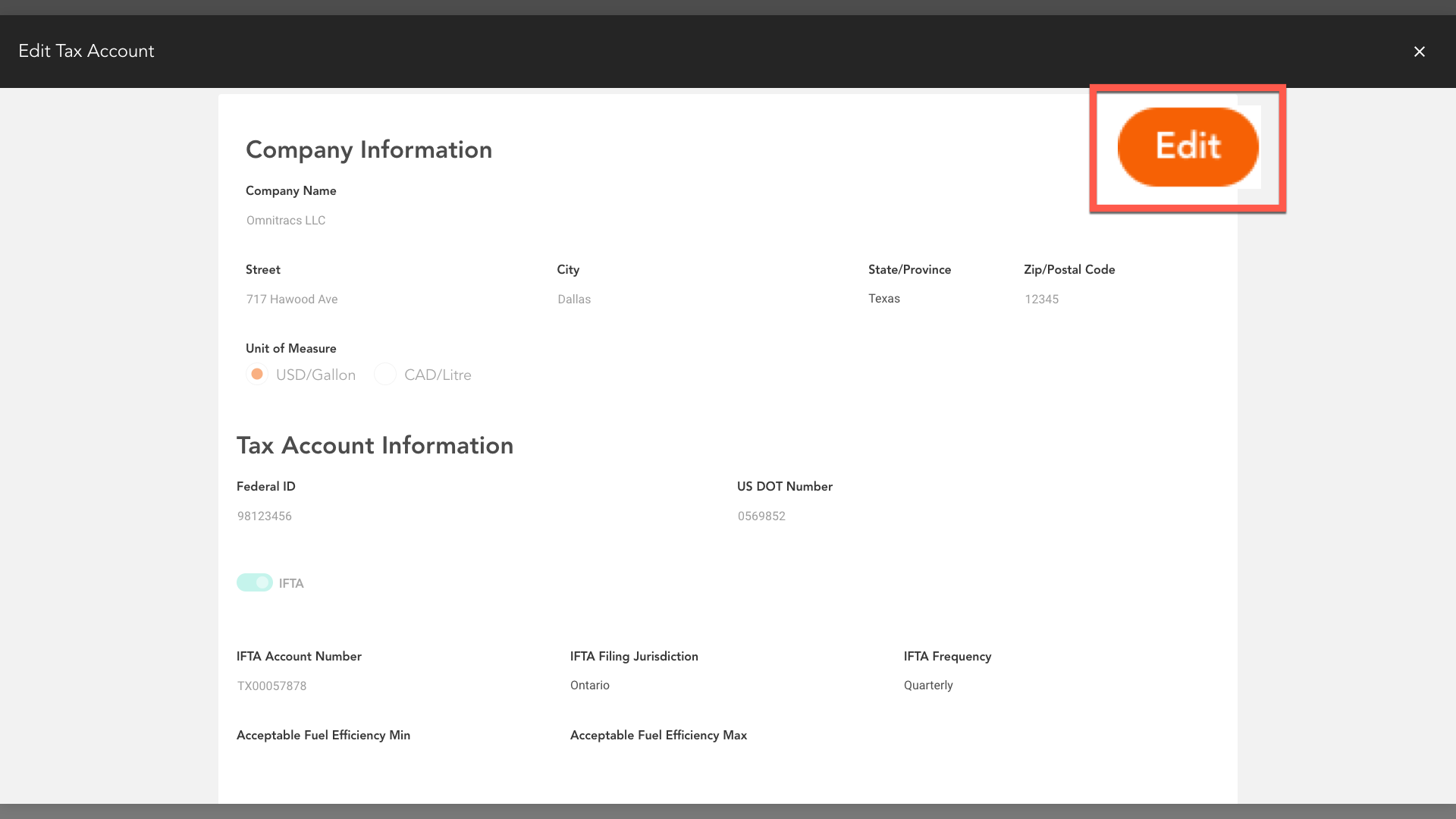

Edit a Tax Account

To edit a Tax Account, select from the list the tax account you want to change.

You will be directed to the EDIT TAX ACCOUNT page.

Click the EDIT button.

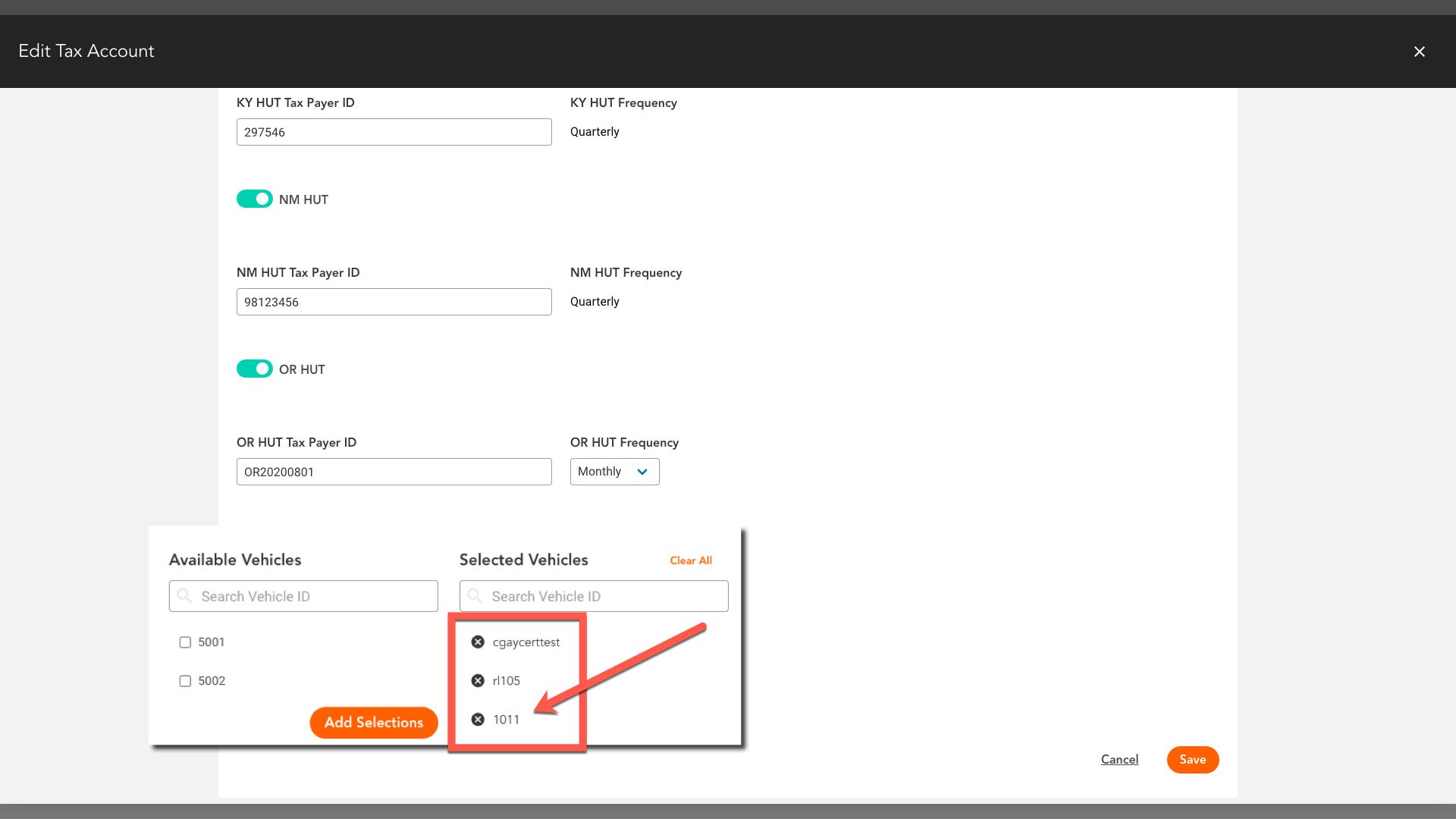

If you need to unassign a vehicle, click on the X next to the vehicle number in the SELECTED VEHICLES column.

This will add the vehicle back to the AVAILABLE VEHICLES column.

When you are done making edits, click SAVE.

Create Tax Account Field Definitions

Starred fields (*) are required.

| Field | Values | Definition |

|---|---|---|

| Company Information | ||

| Company Name * | Alphanumeric | Company Name associated with the tax account being created. |

| US DOT# | Numeric | Official Department of Transportation number. The number must be between 3–9 digits and cannot include non-numerical characters. |

| Street * | Alphanumeric | Street address of company. |

| City * | Alphanumeric | City of company. |

| State * | Select from list | State of company. |

| Zip Code * | Alphanumeric | Zip code of company. |

| USD/Gallon (CAD/Litre) | USD/Gallon (default) CAD/Litre |

Preferred unit of measure. |

| Tax Account Information | ||

| Federal ID * | Alphanumeric | The company's Federal Tax ID. |

| IFTA |

Yes |

Select if you will use this account for IFTA reporting. |

| IFTA Account Number | Numeric | The IFTA account number associated with the tax account. |

| IFTA Filing Jurisdiction | Select from list | The IFTA filing jurisdiction associated with the tax account. |

| Filing Frequency | Select from list | Frequency with which IFTA is filed. |

| Acceptable Fuel Efficiency Min | Select from list | Configurable range for triggering the Fuel Efficiency report for IFTA. |

| Acceptable Fuel Efficiency Max | Select from list | Configurable range for triggering the Fuel Efficiency report for IFTA. |

| NY HUT | Toggle | Toggle On if the vehicles associated with this tax account travel through New York and are subject to the NY Weight Distance Tax. |

| NY HUT Taxpayer ID | numeric | The NY HUT account number associated with the tax account. |

| NY HUT Frequency | Select from list | Frequency with which NY HUT is filed. |

| KY HUT | Toggle | Toggle On if the vehicles associated with this tax account travel through Kentucky and are subject to Kentucky Weight Distance Tax. |

| KY HUT Tax Payer ID | Numeric | The KY HUT account number associated with the tax account. |

| KY HUT Frequency | Select from list | Frequency with which the KY HUT is filed. |

| NM HUT | Toggle | Toggle On if the vehicles associated with this tax account travel through New Mexico and are subject to Mew Mexico Weight Distance Tax. |

| NM HUT Tax Payer ID | Numeric | The NM HUT account number associated with the tax account. |

| NM HUT Frequency | NM HUT tax filings must be generated quarterly. | |

| OR HUT | Toggle | Toggle On if the vehicles associated with this tax account travel through Oregon and are subject to Oregon Weight Distance Tax. |

| OR HUT Tax Payer Id | Numeric | The OR HUT account number associated with this tax account. |

| OR HUT Frequency | Select from list | The frequency with which the OR HUT is filed. |

| Assign Vehicles to Account | ||

| Available Vehicles | Select from list (varies by company) | List of vehicles that belong to the company. |

| Selected Vehicles | Select from list | Vehicles to be associated with the tax account being configured. |