Omnitracs Tax Manager 1.6 Release Notes

Overview

Omnitracs Tax Manager 1.6 has several new features that make it easier for you to report your IFTA tax filings.

- You can now specify if reports use metric or imperial measurements.

- There is a new Trip Details report you can use to assist with reconciliation and comply with requirements for audits.

- There were several enhancements made to the user interface that make it easier to use Tax Manager.

New Features and Enhancements

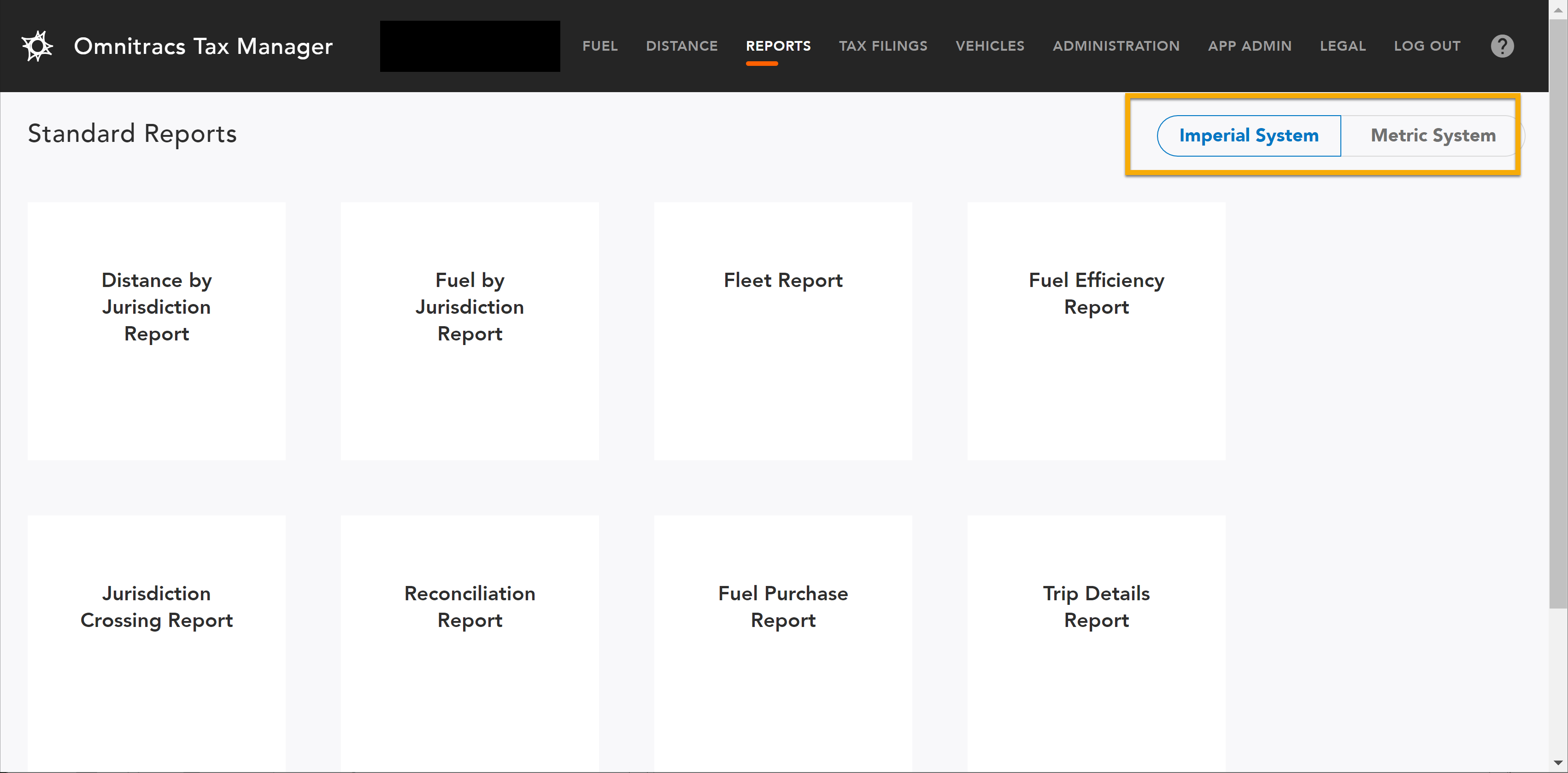

Selecting the Measurement Units for Reports

On the Reports page, click either Imperial System or Metric System. The option you choose will be used on all reports that you run until it is changed.

Generating the Trip Details Report

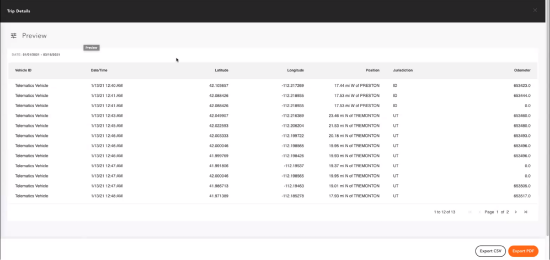

Omnitracs Tax Manager has a new Trip Details report that shows every recorded position of a vehicle, so that in the event of an audit you can provide a bread crumb trail to display where the vehicle traveled through during a selected period of time. The report includes the vehicle ID, the date and time when the Telematics device logged the position of the vehicle, the latitude, longitude, and a description of the vehicle's position, the jurisdiction the vehicle was in at the time and the odometer reading.

- On the menu click Reports. The Reports page opens.

- Click Trip Details Report. The Trip Details Preview opens.

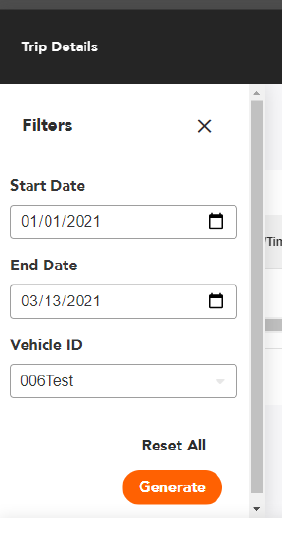

- Click the Settings icon to open the Filters. Choose the Start Date, End Date, and Vehicle ID for the report.

- Click [Generate]. The report is generated and displayed on the screen.

Note: If the date range you select has a very large number of records, you may receive the following error:

Http failure response for https://one-api.omnitracsone.com/rep...reports:search: 429 OK

If you receive this error, reduce the date range and generate the report. - To export the report to a .csv, click [Export CSV].

To export the report to a pdf, click [Export PDF].

Updates to the User Interface

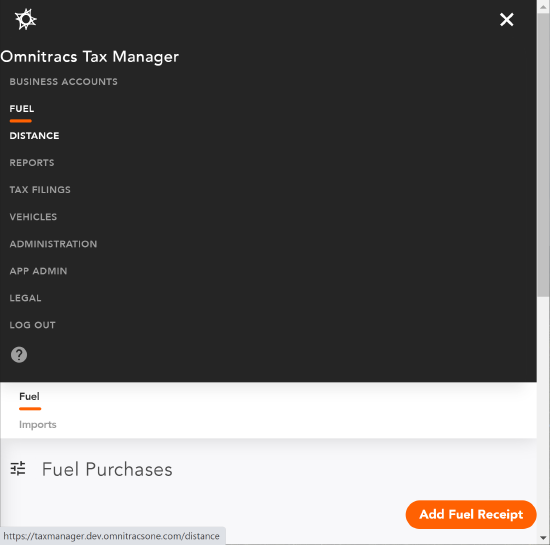

Several changes were made to the user interface to make Tax Manager easier to use.

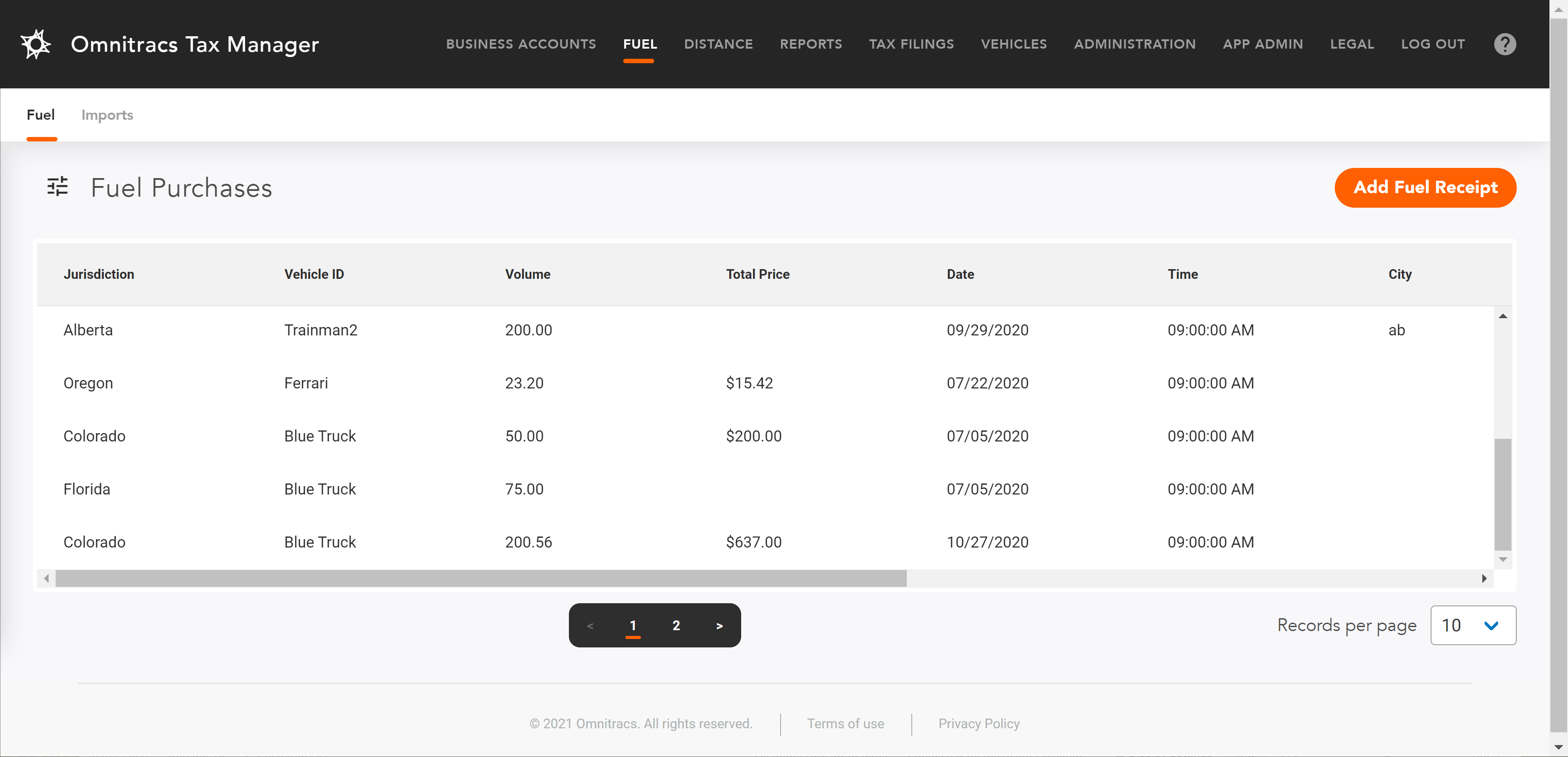

- Horizontal and vertical scroll bars were added to the screen so you can easily navigate through the items. When you scroll down a list of items, the header remains visible to help keep track of what the data represents as you scroll.

- As you resize the window, the grids and menus adjust accordingly. When the window becomes small enough that the menu no longer fits across the screen, the menu options condense under a hamburger menu so that they are still accessible.

Software Corrections

| Item Number | Release Notes | Component |

|---|---|---|

| TM-3161 | Tax Manager has been updated with the first quarter tax rates and surcharges. | Tax Filing |

| TM-3076 | We have corrected a rare issue that could duplicate information when completing NY HUT tax filing reports. | Tax Filing |

| TM-3036 | We have corrected an issue on Montana IFTA Tax filing that caused the Distance and Fuel traveled in "Other jurisdictions" not to be displayed on the official filing. | Tax Filing |

| TM-3025 | We have corrected an issue that was causing the fuel surcharges to display incorrectly in the tax filings. | Tax Filing |

| TM-3018 | There was a rarely occurring situation that could cause fuel receipts to be assigned to the incorrect jurisdiction. This has been corrected. | Tax Filing |

| TM-3034 | There was an issue that was limiting the number of fuel imports displayed in the list. This has been corrected. | Fuel |

| TM-3024 | The Jurisdiction Crossing Report was using the incorrect abbreviations for some states/provinces. This has been corrected. | Reports |

| TM-2982 | The Jurisdiction Crossing Report was using the incorrect abbreviations for some states/provinces. This has been corrected. | Reports |

| TM-2578 | There was an issue that could cause fuel receipts to appear twice in the Fuel Purchases screen. This has been corrected. | Fuel Receipts |