Omnitracs Tax Manager 1.3 New Features & Enhancements

Overview

Omnitracs Tax Manager 1.3 will be released on Tuesday, June 30, and will contain the following new features, enhancements, and software corrections.

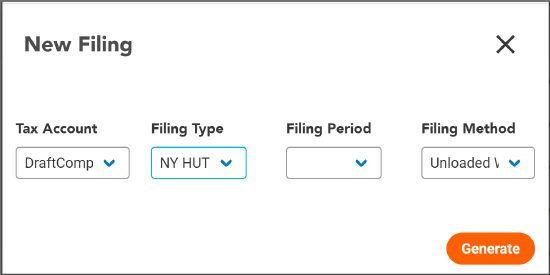

New York Highway Use Tax

You can now create a filing for NY Highway Use Tax using an unloaded method. When creating a filing, simply choose NY HUT as the Filing Type, choose a Filing Period, and select Unloaded Weight Method as the Filing Method.

Tax Manager now identifies miles driven on the New York Thruway and automatically deducts those miles when calculating the New York HUT taxable miles.

Kentucky Weight Distance

Users can now create a tax filing for Kentucky Weight Distance Tax (HUT).

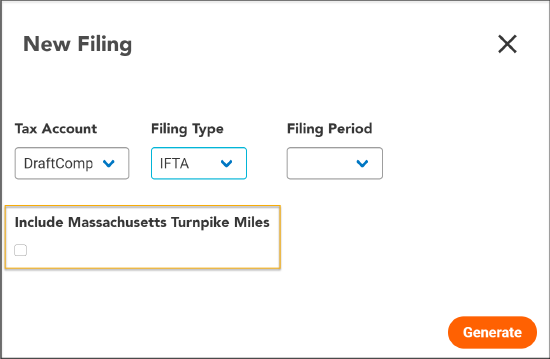

Massachusetts Turnpike Miles Identified

Tax Manager will now identify miles traveled on turnpikes in Massachusetts, and will deduct those miles from the taxable miles when calculating the IFTA tax unless you check the box to Include the Massachusetts Turnpike Miles.

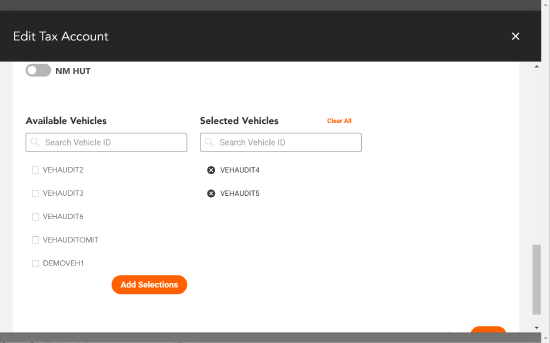

Adding Vehicles to a Tax Account

You can now add multiple vehicles to a tax account. Simply click App Admin, then select the account you want to edit. Click the Edit button. Scroll down until you see a list of Available Vehicles and Selected Vehicles. In the Available Vehicles list, select the vehicles you want to add to the account, then click the Add Vehicles button. The vehicles are added to the Selected Vehicles list.

Changes to Vehicles

Tax Manager 1.3 has several changes to vehicles.

- You can now manually enter vehicles. Simply click Vehicles, then click Create and enter the information for your vehicles.

- The following information can now be included for your vehicles.

| Field | Requirements |

|---|---|

| Unladen Gross Weight | The tractor/trailers unloaded weight as noted on the vehicle's registration. You can enter the weight in either kilograms (kg) or pounds (lb) but it will be converted and displayed in pounds. |

| Licensed Gross Weight | The maximum weight allowed for the tractor/trailer when it was registered with the state or province. You can enter the weight in either kilograms (kg) or pounds (lb) but it will be converted and displayed in pounds. |

| Vehicle Type | Indicates whether the vehicle is a tractor or trailer. |

| Tractor Axles | The number of axles if the vehicle is a tractor. |

| Fuel Type | The type of fuel used to power the tractor or trailer. |

| Trailer Axles | The number of axles if the vehicle is a trailer. Enter the highest axle combination used by the vehicle. |

| Trailer Unladen Gross Weight | The unloaded weight of the trailer as indicated on the vehicle registration. Use the heaviest weighted trailer in the fleet. You can enter the weight in either kilograms (kg) or pounds (lb) but it will be converted and displayed in pounds. |

| Combined Axles | The total number of axles on the combined tractor and trailer. This should be the same as the total of the Tractor Axles and Trailer Axles. |

| Start Date | The date the vehicle was added to the fleet. |

| Termination Date | The date the vehicle was removed from the fleet. |

| Owner Operator Name | The name of the owner operator. |

| NY HUT# | A single field to to enter the current NY HUT permit number. |

| IFTA Decal # | Two fields to enter the current IFTA permit numbers. |

Software Corrections

| Issue key | Release Notes | Component |

|---|---|---|

| TM-2035 |

Several Tax Account fields have been updated: Under IFTA the following modifications were made: |

Tax Account |