Omnitracs Tax Manager 1.4 New Features & Enhancements

Overview

Omnitracs Tax Manager 1.4 will be released on August 3, 2020 and will contain the following new features and enhancements.

New Features and Enhancements

Oregon and New Mexico Weight Mile Tax

Users can now create a tax filing for Oregon and New Mexico Weight Mile Tax (HUT).

Note: In order for Omnitracs Tax Manager to accurately calculate fuel taxes, you must create a tax account and assign vehicles to the account, as well as creating vehicles with accurate information.

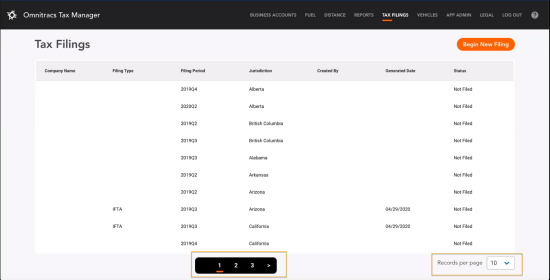

New Pagination Display

Several of the screens in Tax Manager now allow you choose the number of items displayed in a single page. You choose the number of items displayed per page, simply click the Records per Page arrow and choose the proper option.

The following pages had the new pagination added:

- Fuel

- Vehicle

- Distance

- Tax Filing

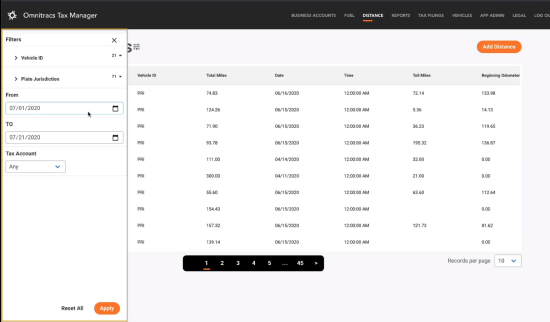

Filtering Pages

To help limit the number of items displayed to only the ones you are interested in, you can now filter some lists in Tax Manager. To filter a list, click the Filter icon; a panel opens showing the filter criteria.

![]()

Choose the proper criteria; items that meet at least one of the selected criteria will be displayed in the list. The following pages have added filtering:

- Distances

- Vehicles

- Fuel

Software Corrections

The following software corrections are in the 4.1 release.

| Items | Release Notes | Component |

|---|---|---|

| TM-2140 | We have rectified an issue that may have resulted in the tax rate not calculating for Indiana. | Tax Filing |

| TM-2161 | There was an issue that was causing tax account creation to fail for Prince Edward Island. This has been corrected. | Tax Account |

| TM-2159 | You can no longer choose the weight measurement on the Vehicles screen; vehicle weights should always be entered as pounds (LBS); labels have been added to the Vehicle screen to remind users. | Vehicles |

| TM-2090 | There was an issue preventing fuel receipts from automatically being applied to the proper vehicle, if the vehicle was manually entered. This has been corrected. | Fuel Receipts |

| TM-2089 | The vehicle was not being displayed on the fuel receipt. This has been corrected and the vehicle ID is now displayed. | Fuel Receipts |

| TM-2194 | There was an issue with VIN numbers that was preventing vehicles from being able to be saved. This has been corrected. | Vehicles |

| TM-2087 |

We have rectified an issue that may have resulted in incorrect weight calculations for New York. This has been corrected. |

Tax Filing |

| TM-2210 | There was an issue that was allowing non-IFTA reportable vehicles to be selected when creating a tax account. This has been corrected. | Tax Account |

| TM-2203 | There was an issue preventing customers from loading large fuel files. The maximum file size has been increased to 8 MB, which should accommodate most files. | Fuel Receipts |

| TM-2177 | There was an issue that was preventing Comdata Fuel files that contained letters in the Comdata Card Number. This has been corrected and letters in the column will no longer cause the import to fail. | Fuel Receipts |

| TM-2176 | There was an issue that was preventing TChek fuel files that contained rows with empty data from being uploaded. This has been corrected. |

Fuel Receipts |

| TM-2220 | We have rectified an issue that could prevent some customers from being able to complete a NY HUT tax filing. This has been corrected. | Tax Filings |