The On-Site Audit

The On-Site Audit

When the auditor arrives, introduce them to your point of contact and explain that any requests need to go to that person. If you've set up special access to your computer system, train for its use.

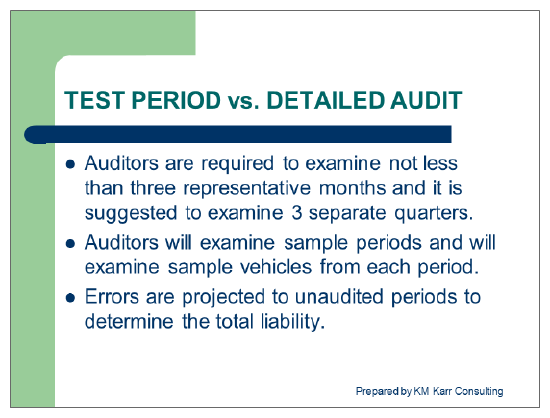

Audit Sampling

Audit Sampling

From the iftach.org auditing manual:

Unless a specific situation dictates, all audits will be conducted on a sampling basis.

- Sample period(s) must be representative of the licensee's operations.

- Sample period(s) may be different for member jurisdictions due to seasonal operations.

- The licensee should be allowed input into sample selection if legitimate reasons exist.

- An agreement that the sampling methodology is appropriate should be signed by the licensee and the auditor.

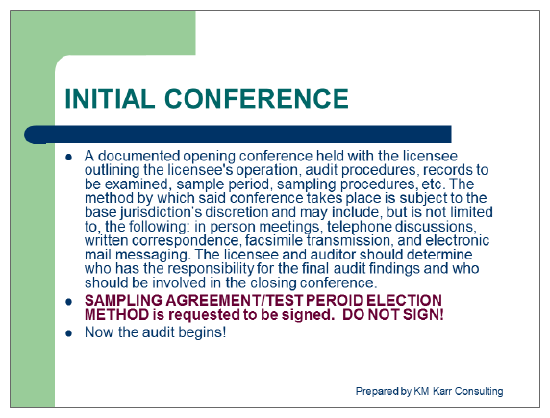

Signing Forms

Signing Forms

At the beginning of an audit, you may be offered a form such as an Audit Election Method form to sign. You are not required to sign any documentation until the end of the audit. A signed form may waive the right to disagree with audit findings.

Focus

Focus

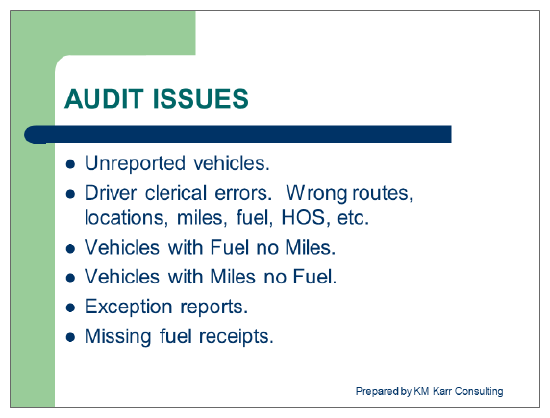

The auditor's primary focus will be vehicle activity. Questions will include:

- How many vehicles do you have?

- How many miles have the vehicles traveled?

- Where did the vehicles travel?

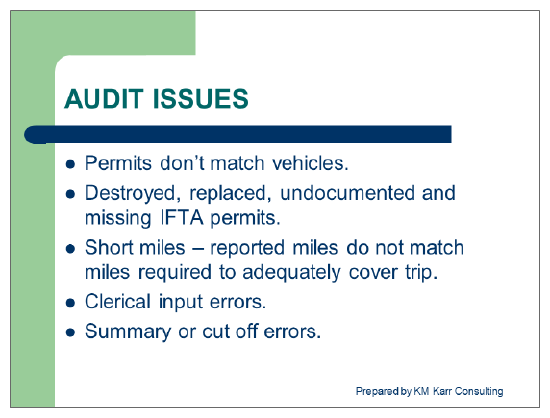

Discrepancies between what is reported and what is actual may prompt an auditor to question the validity of activities. Ensure that the vehicle and mileage inventory/activity matches the information provided to the auditor.

As an example, IFTA permits (decals) are purchased and attached to vehicles. If a company has 100 vehicles and has purchased 150 decals (decals are inexpensive [$2] and are handy for extra, temporary vehicles), the 50 unused decals must be accounted for or the auditor may question whether or not all of the company's vehicles are being reported on.

As an example, IFTA permits (decals) are purchased and attached to vehicles. If a company has 100 vehicles and has purchased 150 decals (decals are inexpensive [$2] and are handy for extra, temporary vehicles), the 50 unused decals must be accounted for or the auditor may question whether or not all of the company's vehicles are being reported on.

Information Examination

- The auditor will likely select vehicles randomly and begin comparing fuel receipts with stated routes.

- With a normal, GPS-based software system, the auditor will use GPS data to map routes, then compare GPS data to miles and locations reported.

Omnitracs One helps this process by drawing mileage information directly from the vehicle's Electronic Control Module (ECM) so there is no need to validate mileage reported versus vehicle movement. It is drawn directly from the vehicle rather than GPS positioning. It may be advantageous to offer the auditor a quick tutorial (or leverage Omnitracs support) on the use of Omnitracs One.

- When examining information, the auditor will:

- Compare units to miles.

- Search for discrepancies between fuel purchased and no miles (or vice versa). Auditors will not be given access to any HOS logs. Reports used to back an IFTA or IRP audit will include the Jurisdiction Crossing report and the Fleet Report or Distance by Jurisdiction Report. If further trip information is needed, the vehicle's Latitude and Longitude will be provided.

- Identify inaccurate placement of miles. If miles need to be reassigned to a different jurisdiction, taxes (and possibly interest) may be owed to the new jurisdiction.

Examination Results

The auditor will show the results of the examination:

- A comparison of vehicles to miles

- Discrepancies between fuel purchased and miles traveled

- Movement of miles into different jurisdictions

- Tax revenue (and interest) owed to different jurisdictions

You may interact with the auditor during the examination and following the presentation of results. Offer reports and trip explanations to reconcile discrepancies.

End of the Audit

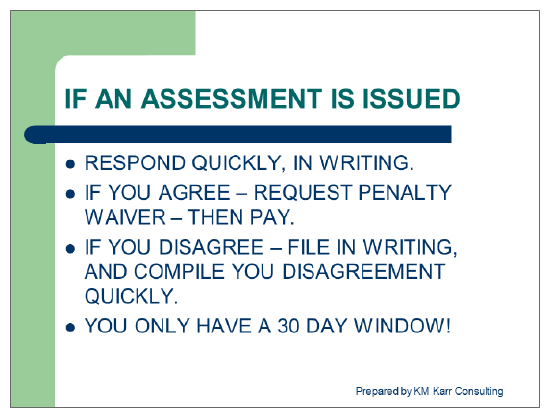

Once the auditor provides an assessment, the company normally has 30 days to respond.

Once the auditor provides an assessment, the company normally has 30 days to respond.

Options following an audit include:

- No action. An audit found no discrepancies.

- Payment. If you do not challenge the results, pay any taxes, interest, or fines owed.

- Challenge results. If you did not sign a waiver, you may:

- Request a more detailed audit. You may also request an extension form.

- Produce documentation disproving the assessment.

- Request a new auditor.